capital gains tax proposal details

For taxpayers with income above 1 million the long-term capital gains rate. President Donald Trump s main proposed change to.

Biden S Capital Gains Tax Proposal Puts Estate Planners To Work Wsj

It would apply to those with more than 1 million in annual income.

. If this happens it. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in. The Democrats Tax Plan Would Raise Capital Gains and Corporate Tax Rates.

It would apply to single taxpayers with over 400000 of income and married. Increasing top tax rates for individuals. Bidens campaign proposal regarding capital gainsthe details.

Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396. Taxpayers with an income of over 1M could lose their preferential 20 treatment on long-term capital gains. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

House Democrats proposed a top 25 federal tax rate on capital gains and dividends. Here are the details of Bidens plan to tax capital gains. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax.

As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. The House Ways Means Committee has released draft legislation of individual tax hikes they propose to pay for the 35 trillion social policy budget plan under consideration. The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level.

With this new plan that rate will increase to a whopping 396--nearly. Payroll Taxes Tax Expenditures Credits and Deductions Tax Compliance and Complexity Excise and Consumption Taxes Capital Gains and Dividends Taxes Estate and Gift Taxes Business. The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or.

Bidens campaign proposal regarding capital gainsthe details. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

Under the proposal a. Monday saw the release of the Democrats full tax proposal which details their plan to pay for. President Biden s Capital Gains Tax Proposal 2022 - First Union.

1 week ago As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain.

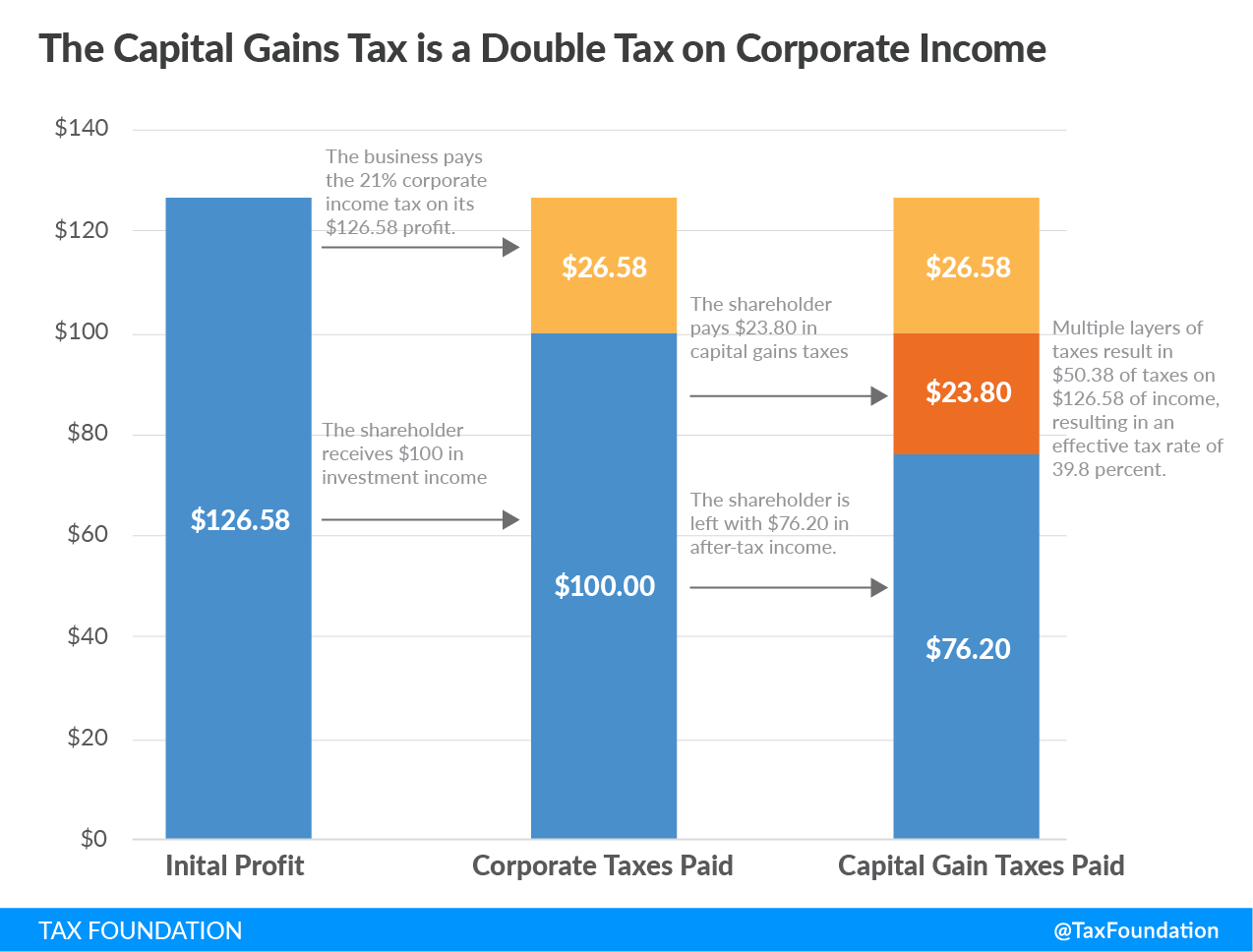

An Overview Of Capital Gains Taxes Tax Foundation

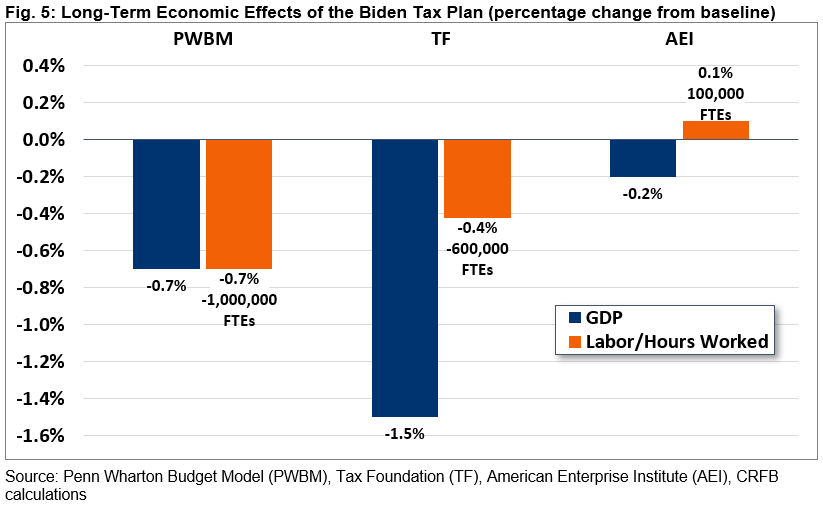

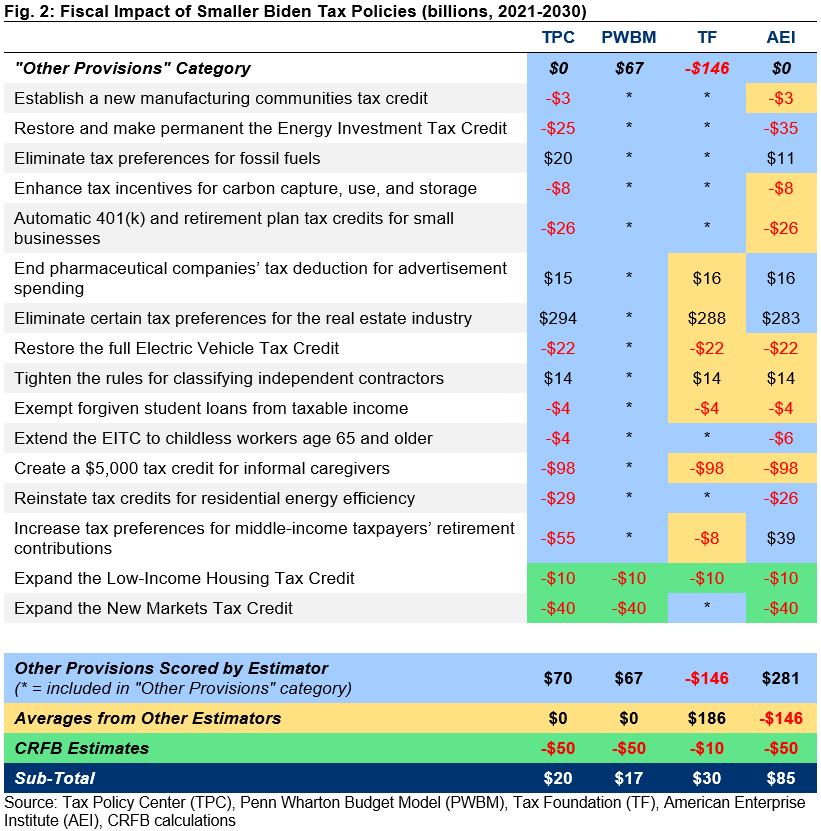

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

House Democrats Propose Hiking Capital Gains Tax To 28 8

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

Wyden Fills In Details For Billionaires Income Tax Politico

An Overview Of Recent Tax Reform Proposals Everycrsreport Com

Us Tax Law Changes Deloitte Us

Capital Gains Tax In The United States Wikipedia

What S In The Democrats Tax Plan Increases In Capital Gains And Corporate Tax Rates Wsj

Biden Focuses On Capital Gains Taxes As He Seeks Money For Social Programs Wsj

Biden Seeks Tax Hikes On Wealthy To Pay For Ambitious Families Plan

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

Biden To Propose 20 Tax Aimed At Billionaires Unrealized Gains Bloomberg

Capital Gains Tax In The United States Wikipedia

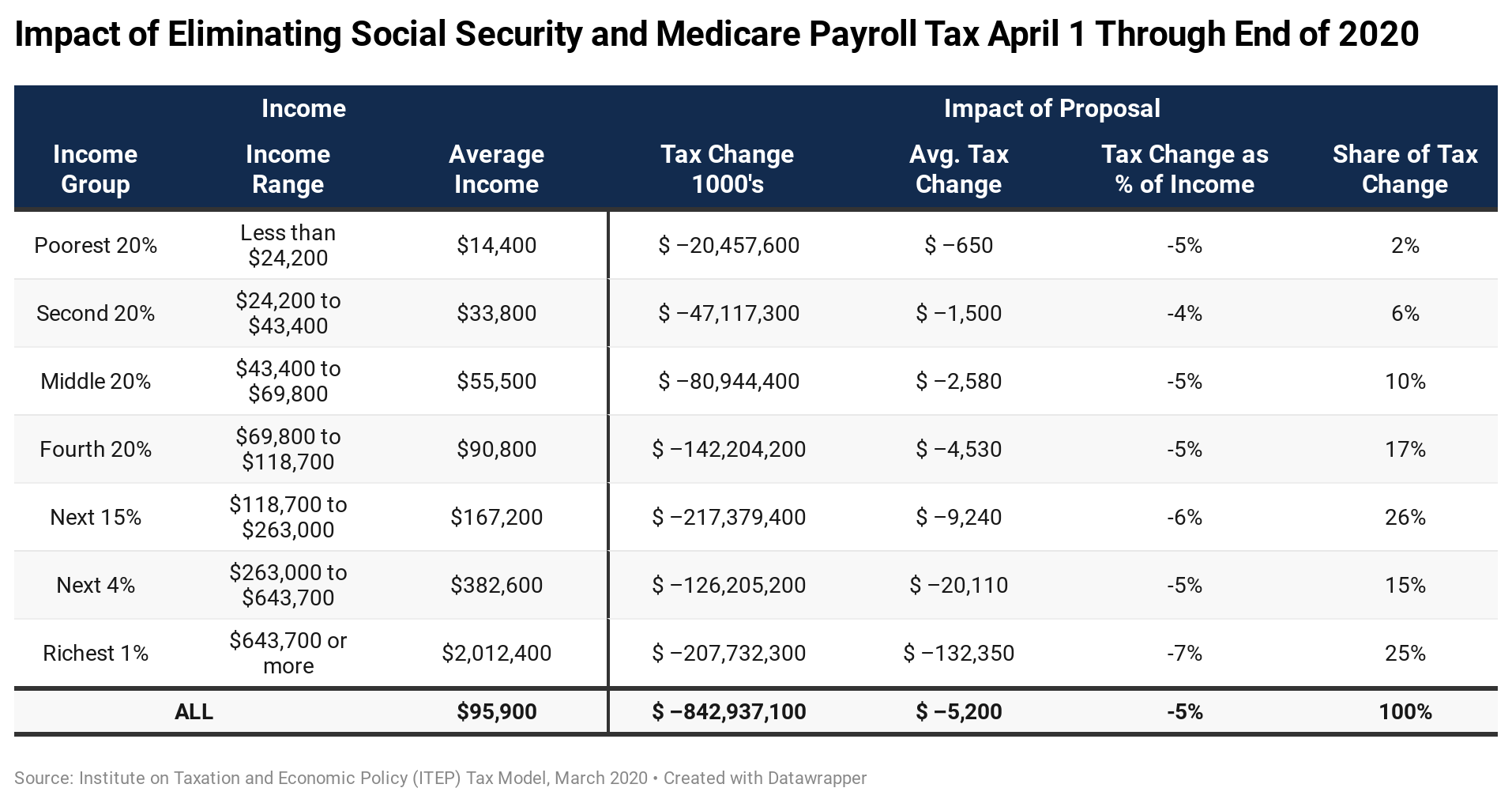

Trump S Proposed Payroll Tax Elimination Itep

President Biden S Capital Gains Tax Plan Forbes Advisor

Weekly Market Update What The Proposed U S Capital Gains Tax Increase Means To Investors Point Of View

Opinion Biden Proposes A Big Change To Capital Gains Taxes This Is How They Work And Are Calculated Marketwatch